2021-present

@U.S. Bank*

*Unfortunately, U.S. Bank — being a large and highly regulated institution — doesn’t allow design assets to be shared outside of work devices. Out of respect for that, this case study includes fewer visuals than I’d like. Thanks for understanding — and for bringing a little imagination along.

I joined U.S. Bank as a Senior Product Designer focused on the account management experience for consumer products — including checking, credit, mortgage, etc. accounts serving the Banks individual and small businesses markets.

My work spanned multiple platforms, designing for responsive web (React) as well as native iOS and Android applications.

I joined U.S. Bank as a Senior Product Designer focused on the account management experience for consumer products — including checking, credit, mortgage, etc. accounts serving the Banks individual and small businesses markets.

My work spanned multiple platforms, designing for responsive web (React) as well as native iOS and Android applications.

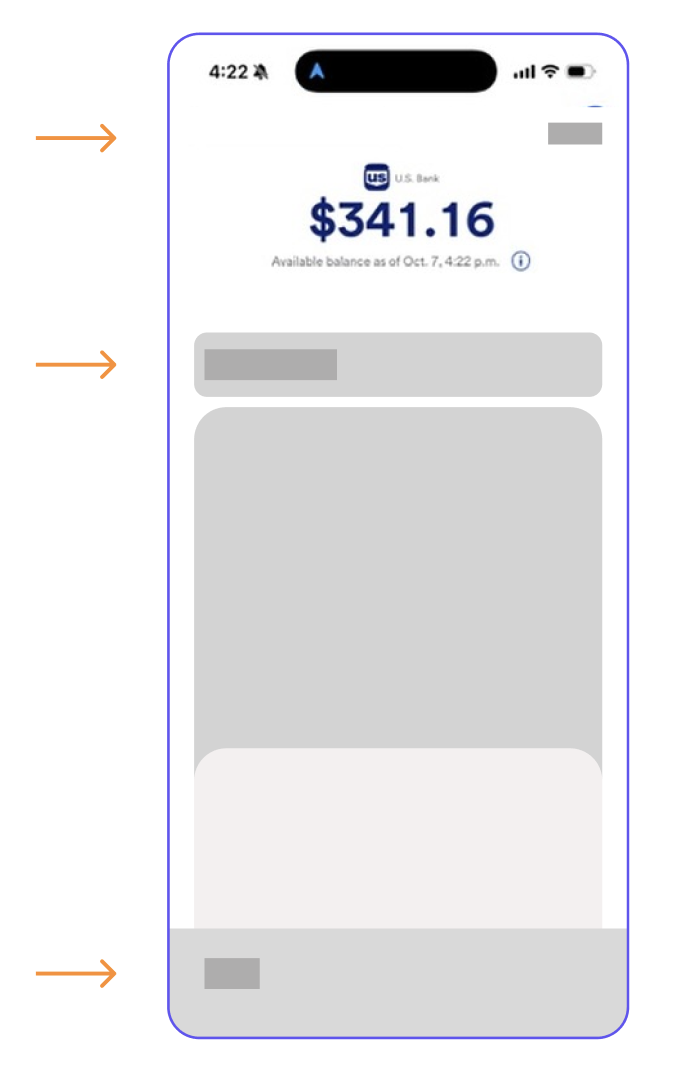

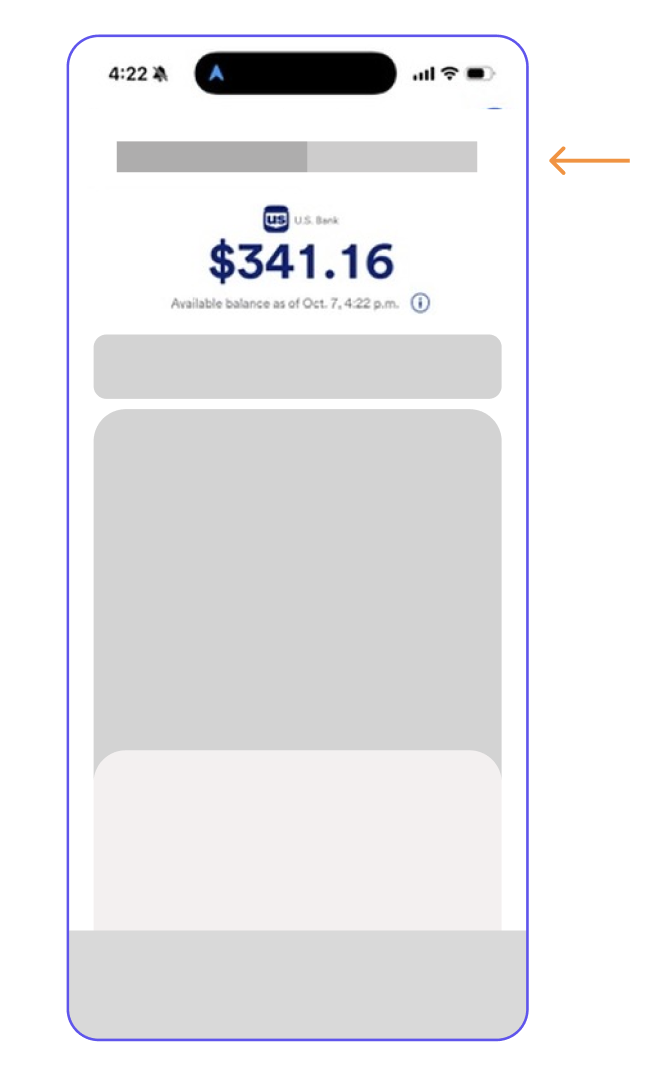

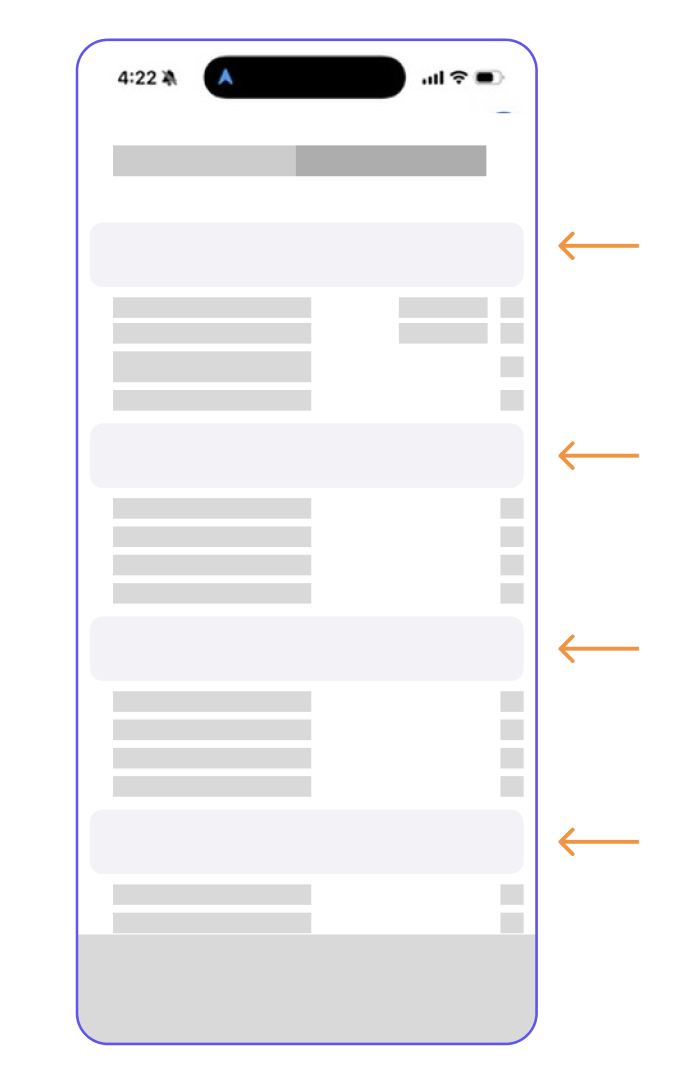

Illustrated example:

User research revealed that a significant number of customer support calls were driven by users struggling to locate key account information.

Critical features—such as account details, settings, services, and card management—were fragmented across multiple separate entry points, organized in a way that didn’t align with users’ mental models.

My work ranged from designing interstitials that guided users into new products (prior to implimenting Pendo) to restructuring the information architecture for all account-related settings and actions.

As the lead designer, I focused on deeply understanding user mental models through card sorting, observation, affinity mapping, and journey and service mapping. These insights informed iterative design improvements, which we validated through pilot testing with real users.

Following the exercises with end customers, internal business lines, and other stakeholders, we centralized account-related features and prioritized their organization based on how customers naturally grouped associated actions

One high-impact feature I led (see example) was the redesign of our consumer account management platform, which launched to over 1 million users, improved usability by 30%, and reduced support calls by 15%.

We focused on understanding users’ mental models around “services” versus “details,” and structured the information hierarchy based on usage frequency.

This experience opened the door for me to join the Corporate Wealth Management and Investment Services design team. I currently lead design initiatives focused on cash management and pricing valuations, helping large corporations more effectively manage, allocate, and invest their cash holdings.

Our work centers on integrating multiple lines of business into a unified legacy platform while enhancing its capabilities and usability through improved experience design and the continued evolution of the U.S. Bank design system.

I’d be happy to discuss this work in more detail and answer any questions.

I look forward to connecting.✌️

Our work centers on integrating multiple lines of business into a unified legacy platform while enhancing its capabilities and usability through improved experience design and the continued evolution of the U.S. Bank design system.

I’d be happy to discuss this work in more detail and answer any questions.

I look forward to connecting.✌️